How to Set Financial Goals (And Stick with Them)

How to Set Financial Goals (And Stick With Them)

When you were a kid you would save up for a new toy, as a teenager you saved up for a car, now you’re probably trying to get out of debt. No matter your age, you will always have financial goals set for yourself.

But could you be doing it wrong?

Most of us don’t have any problem setting financial goals for ourselves, but it’s sticking to them that we can’t get quite right.

I’m sure you’ve been in a situation like this:

You decided that you want to save up for your dream vacation, you want to get better at budgeting, or you want to pay off your credit card. You resolve to stick with it, and you do! … for a week. Then, something happens and it all falls apart and the cycle starts over again. There’s no shame in it, it happens to all of us. There is a better way, though, and I am about to tell you how.

Be SMART About It:

When creating a financial goal, the biggest pitfall you could possibly have is being vague about your goal. So many people say something like, “I want to take a trip to Paris,” “I want to pay off my debts,” or “I want to grow my retirement fund,” and find themselves unable to achieve their goals because they were too vague. If you do this, your journey is over before it even began.

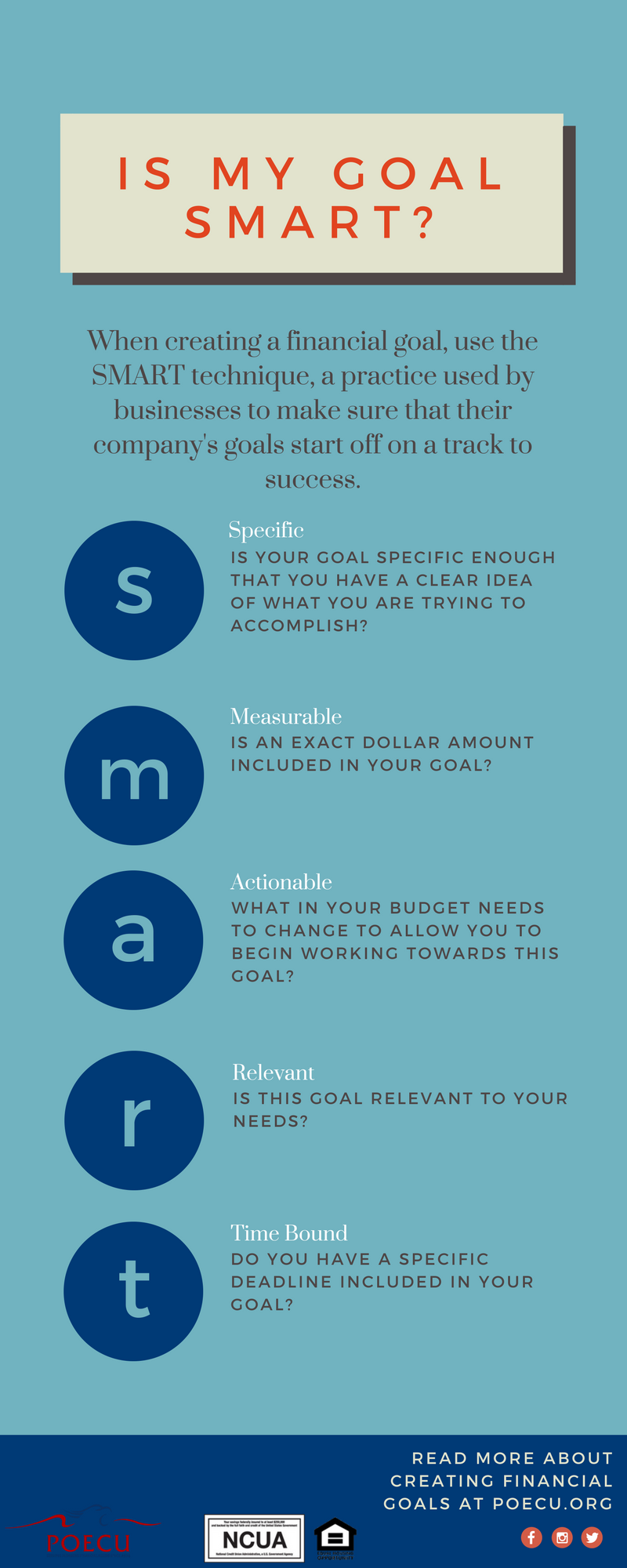

To make sure you start your journey off correctly, use the SMART technique. This is something used by businesses to create action plans and it works very well to create financial goals. SMART stand for: specific, measurable, actionable, relevant, and time bound.

Here's how it works:

Let’s use the Paris example since that is the most fun!

The original statement was: “I want to take a trip to Paris.”

Let’s change that to: “I will save up $5,000 by November in order to take a two week trip to Paris next May.”

Is this goal SMART?

Specific: The original statement was too vague; therefore, you couldn’t possibly stick with your goal. When did you even want to take the trip? Next year, in the next ten years? How much would it cost? It’s hard to justify delaying gratification to save for a bigger goal if you don’t even know when that target will be recached or how much it will even cost to get there. That is why you need to start off with something very specific in mind.

Measurable: When talking about a financial goal, this pertains to how much it will cost. In our case, it is $5,000. You can keep track of $5,000 and physically see yourself making your way towards your goal. It is much easier to stick with a goal when you set a concrete amount of money and you can keep track of how close you are to getting there.

Actionable: Is this a goal that you can take action with at this time? Maybe you take a look at your budget and realize that there is no way that you can possibly set aside enough money each paycheck to reach $5,000 by November. If that is the case, you will either have to rework your goal, or table it completely until you reach a point where you can start to save that money. If you look at your budget and see that you are able to rework it to set aside that money, then keep moving forward with it!

Relevant: This one is common sense to the point that you don’t really have to worry about it when making your goals. Basically, is this goal relevant to you? None of us are setting goals that aren’t relevant with us to begin with.

Timebound: I cannot stress enough about how important this one is. If you do not set yourself a deadline, you will not reach your goal. It is so easy to slip from your goal when you do not have a clear deadline in place. Do not underestimate the power of procrastination. In our case the deadline is in November, so we’re set!

Let’s look back at the other two goals we mentioned and make them SMART:

Instead of: I want to pay off my debts.

Say: I will to pay off my $30,000 student loan debt by January 2022.

Instead of: I want to grow my retirement fund.

Say: I will have a retirement portfolio of $2,000,000 by the age of 65.

Once you have created these goals, you can then make an action plan for reaching them.

Create an Action Plan:

Now it’s time to sit down and figure out the specifics of reaching the goal that you set out for yourself. First, you will need to figure out how much money must come out of each paycheck to reach your goal in the allotted time. I say per paycheck instead of per month because it is easier to hold yourself accountable this way. If you break down the cost by month, you may be tempted to hold off on taking money out of your first paycheck and take the entire monthly sum out of your next paycheck; before you know it, you’ve fallen behind and you’re discouraged from continuing on. Having a set amount to take off the top of each paycheck prevents that, plus the consistency makes budgeting easier.

So let’s say:

We want to save up $5,000 within the next eight months for our trip to Paris. Most people get paid twice a month, so that means that you have 16 paychecks to come up with $5,000. $5,000/16 comes out to be $312.50 taken out of each paycheck. How much do you have left over after this amount is taken out? Do you have enough to cover all of your expenses?

Pro Tip: If your goal is to pay off a loan, make sure you factor in both principle and interest when figuring out your payments. I personally suggest using the snowball method created by Dave Ramsey if your goal involves getting out of debt.

Once you figure out how much you would need to take out of each paycheck, the next step is to take a look at your budget and figure out how you can accommodate this new expense.

Chances are, you’ll have to make some sacrifices in your budget to reach your target. If you need some inspiration on where to cut your budget, check out this blog where we give some ideas on where you can cut your budget. Depending on how big your goal is, you may need to make some pretty big sacrifices for a time. If you want to see this in action, read this blog post by someone who paid off their mortgage in five years.

You should always be ambitious with your goals, but remember that sometimes there will be endeavors that are too expensive. You may take a look at your budget and realize that there is just no way you can reach your goal by the deadline. In that case, either extend the deadline, or in the case of less consequential goals (like taking a trip to Paris), table it until you’re in a financial position where you can take up the ambition again.

That is the whole point of planning out your goal like this:

It is better to know at the beginning if you can’t reach your target in the allotted time than slowly realizing it halfway through. Creating a plan like this keeps you organized, accountable, and most importantly, helps you figure out how to make it possible.

That is the biggest problem that most people have with goal setting:

People have grand ideas, but never sit down to figure out a plan for turning those ideas into a reality. When this happens, the goal ends before it even began. Instead, use the SMART technique and create an action plan to ensure that you will reach your target every time!